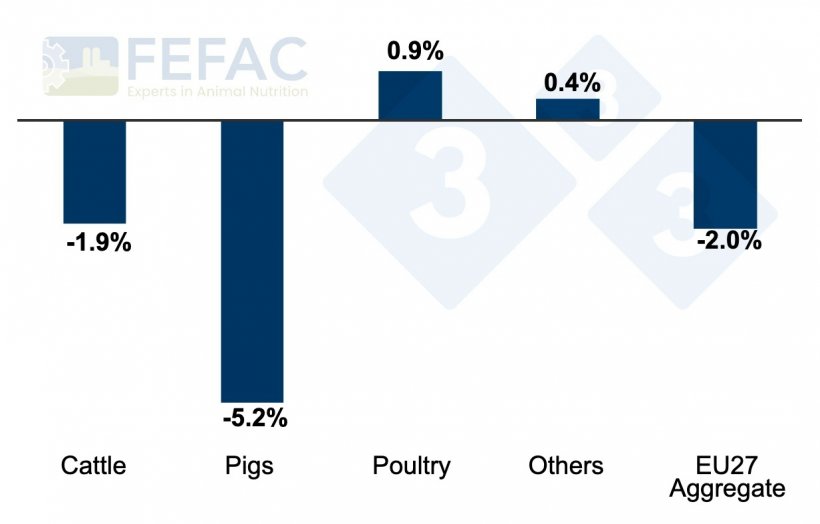

EU compound feed production (EU27) for farmed animals in 2023 is estimated at 144.3 million tonnes, reflecting a 2% decrease compared to 2022, according to data forecasts provided by FEFAC members.

The EU feed market in 2023 reflects continued political and market crisis management pressures and a growing demand for providing sustainable feed solutions to address market dynamics and regulatory considerations. These trends are a response to the adverse impacts of climate change and animal diseases on the supply of raw materials, such as droughts and floods, and on animal production capacity, including Avian Influenza (AI) and African Swine Fever (ASF). Additionally, national policies ranging from greenhouse gas reduction goals to nitrate emission regulations, have contributed to these shifts.

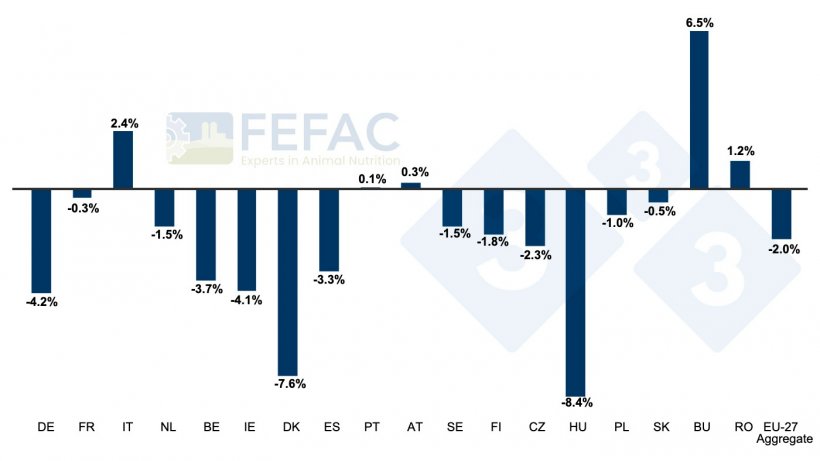

Compound feed production is different across Member States: while countries such as Germany, Ireland, Denmark, and Hungary have witnessed approximately a 5% decline in feed production, other countries like Austria, Bulgaria, Italy, and Romania, have experienced a modest increase. The remaining Member States have either marginally decreased their feed production or maintained it at a level similar to the previous year.

Similar to 2022, the pig feed sector was most severely affected in 2023, experiencing a further decline of almost 2.5 million tons. Germany, for instance, faced a reduction in pork production due to the loss of Asian export markets and was targeted by negative media campaigns. Denmark witnessed a substantial drop of -13.6% in pork production in 2023. Spain, the largest EU pig feed producer, lost 800,000 tonnes of production due to shifting consumer preferences (food price inflation) and the loss of export markets. Meanwhile, Italy continued to grapple with challenges posed by African Swine Fever (ASF).

Regarding the outlook for compound feed demand in 2024, the scenario remains uncertain. Key factors, such as the impact of animal diseases, economic uncertainty, persisting high food price inflation, ongoing weather irregularities, and the increased imports of poultry meat products from Ukraine, are affecting local production. The influence of “green and animal welfare” policies is expected to adversely impact the market outlook for livestock and feed production, although costs for key feed materials, mainly feed cereals, have fallen back to levels before the Russian invasion of Ukraine.

PigUA.info by materials pig333.com